$ENIOR I$$UES

|

|

For the last nine years, I have served as editor and primary writer for Amazing Aging, Jayhawk Area Agency on Aging's quarterly newspaper. On this page I am focusing on articles of interest to seniors (and those who love them) that help them protect their health and save their money. The majority of these articles were published in Amazing Aging.

|

|

MONEY MATTERS

Lowering property and sales taxes in Kansas is way overdue

Marsha Henry Goff

Property tax relief is needed for Kansas seniors

Marsha Henry Goff

|

On November 15, 2017, Kiplinger listed the ten most tax-friendly states for retirees and the ten least tax-friendly states. Want to know where Kansas ranked? Our state ranked in the ten least tax-friendly states, eighth from the bottom, meaning there were only seven states out of 50 that were less tax-friendly to seniors than Kansas.

In making their determination about our state’s low ranking, Kiplinger notes: The state’s combined state and local sales tax rate is the eighth-highest in the US. Property taxes are above average for the US, too. [While Kansas offers a Homestead rebate, given limitations, it is not helpful to many whose incomes, though low, are not low enough to qualify.] I remember driving a visiting out-of-state cousin, who once lived with us, through the neighborhood where I grew up. “What happened to these houses?” she asked. “They used to be so well cared for and now they look shabby.” “It is because they are owner-occupied,” I explained. “The owners have grown old and are no longer physically able to maintain their property and cannot afford to pay someone to do it.” That is the case in neighborhoods throughout our nation. However, in those states where senior homeowners’ property taxes are capped, frozen or valuations adjusted, seniors may be able to afford to pay people to maintain their homes when they are no longer physically able to do it themselves. In states where property tax is high and there is no relief for seniors — given their declining purchasing power for |

necessities — property taxes are, in many cases, confiscatory, causing seniors to lose their homes to tax sales. Others may be forced to sell and relocate to apartments, while some try to stave off the inevitable by taking out a reverse mortgage.

Kiplinger is not the only publication to note that Kansas is not tax-friendly to seniors. Money, published by Time, Inc., also ranks Kansas in that group of not tax-friendly states, writing: Property taxes tend to be especially burdensome in the least tax-friendly states. According to the Mid-America Regional Council, serving the Kansas City area, 70 percent of seniors are spending 30 percent or more of their income on housing while 40 percent spend half; 70 percent of Medicare beneficiaries spend 10 percent of their income on medical expenses. Older, poorer seniors spend closer to 25 percent; 20 percent of those over age 65 will never be able to retire and 50 percent are one event away from being forced into economic hardship and bankruptcy. The US Census in 2017 states that 15 percent of Kansans are 65 or older. As more Baby Boomers retire, that number is expected to double. Kansas seniors have lived productive lives. Many are veterans. All have worked hard to earn the benefits they have in Social Security and other pensions. Kansas must do better for its seniors. A good place to start would be property tax relief which will allow them to stay in the homes they love. |

Seniors’ declining standard of living

Marsha Henry Goff

Marsha Henry Goff

|

You do the math. Seniors on Social Security received a 2% COLA (Cost of Living Adjustment) in 2018. That was virtually wiped out for many by the $134 Medicare Part B premium. The premium was the same in 2017 when the COLA was .03%, but that year’s premium was a 10% increase from the premium in 2016. Because of this year’s 2% raise, however, the $134 premium applied to a great many more seniors on Medicare.

Here’s the rub. Many Social Security recipients’ Supplemental Insurance plans rose. My husband’s and mine each rose 10%, dental rose 11% and Part D Drug plans rose a whopping 20%. However, the Social Security COLA does not consider health insurance as one of the inflation factors for raising your benefit. According to the US Labor Department’s Bureau of Labor Statistics: Although medical insurance premiums are an important part of consumers’ medical spending, the direct pricing of health insurance policies is not included in the CPI. As explained below, BLS reassigns most of this spending to the other medical categories (such as Hospitals) that are paid for by insurance. The extreme difficulty distinguishing changes in insurance quality from changes in its price forces the CPI to use this indirect method. If you have been grocery shopping recently, you know food costs are going up along with most retail items. My city of Lawrence recently raised its water, sewer and trash rates by $65/year for the average user. The city also raised its property tax mill levy by 1.25 mills, the county by 1.9 mills and an approved bond issue for school improvements will raise the school district’s budget by 2.4 mills. Those mill figures may sound innocuous, but they can represent hundreds of dollars owed in property taxes by seniors who own their homes. Even those who rent may be affected when their landlords are forced to raise rent to pay their own property taxes. It is expected that other cities and counties also raised their property taxes and utilities. When is the last time your property taxes and utilities were lowered? No wonder seniors are struggling to stay afloat. But not to worry. In 2016, USA Today ran an article with this helpful advice for seniors: |

1. Raise your income by increasing the return on your investments or getting a job;

2. Lower your expenses by downsizing your house or taking out a reverse mortgage. (Be cautious about the latter; although reverse mortgages work for some, they are not right for everyone. See more about reverse mortgages in a reprinted article from 2013 on page x). 3. Do both — raise your income AND lower your expenses. If only it were that easy. In an interview published in the Fall 2017 issue of Topeka Senior Magazine, JAAA Executive Director Susan Harris addressed seniors’ financial difficulties by noting that many of them were working longer out of necessity: “In many cases, there is a need for the additional income. A lot of folks stop working and they’re limited to just their Social Security or their pensions or what they’ve been able to save. Oftentimes, that’s just not enough. So we see a lot of seniors where it’s really a financial need. They have to go back to work.” The day you retire and start drawing Social Security and/or a company pension you are said to be on a “fixed” income. But the reality is you are actually on a “declining” income with regard to what the benefits you earned will buy. What can seniors do to attract attention to their plight? Write your representatives in Washington! While you may be accustomed to hearing from politicians during elections when they may attempt to scare you into voting for them to preserve the Social Security payments you earned while you were working, do they ever hear from you? It is up to you to educate them with regard to the problems created after retirement when necessities raise by 10% while your income raises by 2%. The method of calculating COLAS are confusing to say the least. For example, COLAS offered by the government can vary widely as evidenced by the fact that FERS (Federal Employees Retirement Service) pensioners received a 5.8% COLA in 2009, while Social Security pensioners received 0.0%. Why? Logic tells us that inflation affects seniors the same regardless of whether they paid into Social Security or the Federal Employees Retirement Service. |

Why are our seniors being left behind?

Marsha Henry Goff

Marsha Henry Goff

|

Two articles in the last Amazing Aging — “Property tax relief is needed for Kansas seniors” and “Seniors’ declining standard of living” — prompted many comments . . . and not from those you might think. Retired seniors who spoke to me are those who planned for retirement and thought they had sufficient funds to enjoy a comfortable life after the paychecks stopped.

They were willing for me to tell their stories and were candid in voicing their worries about the future, but — for obvious reasons — asked me to not use their real names. Their stories are true. Their concerns are real. It was a shock to them to learn they had not counted on living expenses — all living expenses, not just a few — rising so fast. Even soon-to-be retirees are worried. Cheryl and her husband built their dream home a dozen years ago. With two incomes, their home was easily affordable when they built it and in the years since, but property taxes have risen so fast that Cheryl is worried they will be taxed out of their home and forced to sell once they are relying on retirement incomes. “We are not going to deplete our 401Ks just to pay taxes,” she says. Sally, a retired educator with a KPERS pension, has taken a part-time job just so she can travel while she’s still young enough to enjoy it. She acknowledges that she will be able to extend her standard of living in the near future with some belt-tightening, but worries that with a fixed income, rising prices and an onerous real estate property tax, she will eventually be forced to downsize. Sally hopes legislators will do something to enable seniors to stay in their homes. Rachel has health challenges that require her to use a wheelchair. Currently she is worried that she cannot find businesses that will accept Medicare to replace or maintain durable medical equipment (e.g., wheelchairs, hospital beds, insulin pumps, oxygen equipment). She spent three hours phoning and searching the Internet and found only one repair entity that accepts Medicare to repair her wheelchair. Three weeks after contacting them, her repair is still not completed. She notes that costs for food have risen significantly in the last year, as have utility costs and is greatly concerned that Westar is asking for a rate increase that would raise customers’ bills by $52.6 million annually. She adds, “My prescription drugs costs have doubled due mostly to changes in the Tier. Three years ago, my HOA dues increased $300 annually.” A home with a home owner’s association is essential to her because she can no longer do yard work nor shovel snow. Rachel says that recent tax changes are more likely to hurt her than help because, while the standard deduction is increasing, many of her deductions are being phased out. Changes to the medical deduction are particularly concerning to her, because her costs far exceed 7.5 percent of her gross income. But she admits that, “What worries me most is the rise in property taxes and valuation. Although I downsized into a smaller, less valuable home several years ago, I am now paying about $400 more in taxes and within the last six months I received notice that the valuation on my property rose |

$10,000, making a rise in both property taxes and insurance a certainty.”

She has had to increase withdrawals from her retirement savings to supplement her Social Security and that worries her because she figures that, with careful budgeting, she can maintain her current standard of living — comfortable, but not extravagant — for only five or six years without making substantial sacrifices. Chris and Louanne, with two Social Security checks, one pension and two IRAs thought they were primed for an enjoyable retirement. But that was 20 years ago. Their income has remained the same for two decades and IRAs have been tapped, but their not-too-distant future does not look at all golden. Their budget does not allow the traveling that they hoped to do. And, though their home is paid for, they — as do Cheryl and her husband — worry that ever-increasing property taxes will force them out of their home. Like many seniors, Janice is working part-time, not because she wants to, but because she must. “My Social Security amount stayed the same because the COLA was wiped out by the rise in medical insurance. Gas prices are up, food prices are up. Utilities are going up. The car insurance on my same car went up because my age went up.” “To live comfortably,” she says, “you just can’t do it! When you’re working hard all your life to make ends meet, you can’t put away the $200,000 in cash or stocks that retirement homes suggest you need to move into their facilities.” The economy is presently doing well which is great for those who see their paychecks rising after remaining stagnant for so long. Seniors, however, do not feel the benefit of a rise in their income when a two percent raise in COLA is offset by up to a ten percent raise in insurance as well as increases in utilities, groceries and other retail goods. The income tax reduction helps working families, but it does little for seniors, the majority of whom pay very little, if any, income taxes due to their greatly reduced incomes. Why are seniors being left behind by their federal, state, county and city elected officials? It is likely not by design, but because those officials simply do not consider the devastating impact their decisions to raise taxes has on seniors. Many states realize how burdensome property taxes are to seniors and take steps to relieve them of some of that burden. Kansas is not one of those states and that is creating a new class of poor in our state: retirees who worked hard all their lives to buy their own homes and who prepared for retirement, but didn’t count on property taxes rising so quickly and so much. The writer of a recent letter to the Journal-World said that Douglas County property taxes have risen 40 percent in the last ten years. Such a rate increase is untenable to seniors whose incomes are static. Kansas seniors are crying for help with their property taxes. The time for state officials to act is now. And it is also time for seniors (and those who love them) to contact their representatives and urge them to provide seniors with critically-needed property tax relief. |

Both property and sales taxes are regressive

Marsha Henry Goff

Marsha Henry Goff

|

Most elected officials recognize that sales taxes are regressive, i.e., the tax takes a larger proportion of the income of low-income individuals than from high-income individuals. That effect is mitigated when groceries are excluded from sales tax. Kansas, however, is one of only seven states that tax the purchase of groceries. The other states are Alabama, Idaho, Hawaii, Oklahoma, Mississippi and South Dakota.

What many elected officials do not seem to understand is that property taxes are also regressive when imposed on low-income seniors who own homes they have lived in for decades. While their incomes remain fixed, their money buys less. Costs of everything are rising: food, utilities, home upkeep and insurance. The Bureau of Labor Statistics shows how the average costs of food have risen the past 10 years (the first cost is 2008, the second 2018): loaf white bread, 1.08/1.41; pound of butter, 1.99/3.69; dozen eggs, 1.31/1.75; ground beef, 2.33/3.80. |

Kansans are aware that electric bills have increased in recent years. Based on electric rates per kilowatt hour in April 2018 (the latest month available), Kansas ranks 32 among 50 states, paying 13.59¢ per kWh, while surrounding states pay less: Colorado, 12.06¢; Missouri, 10.36¢; Nebraska, 10.55¢; Oklahoma, 11.05¢. Missouri and Nebraska rank among 10 states with the lowest electric rates. In 2015, Kansas saw the second biggest increase in homeowners insurance rates of all states. From 2007 to 2015, Kansas average yearly insurance rates jumped by $627.

Add ever-increasing local property taxes and the threat of the legislature raising state property taxes and some seniors in Kansas legitimately worry about being taxed out of their homes. The economy has definitely improved and — along with income tax reform and wage increases — greatly benefits working individuals and families. That is a very good thing, but seniors also deserve to benefit from an improving economy and should not be forgotten. |

Is a reverse mortgage right for you?

Marsha Henry Goff

Marsha Henry Goff

|

Among the celebrities promoting reverse mortgages for seniors age 62 and older are Robert Wagner, Fred Thompson, Henry (the Fonz) Winkler and Pat Boone. If it seems odd that wealthy celebrities — who will never need such a mortgage — are encouraging their fellow and poorer seniors to take advantage of the program initially signed by President Ronald Reagan in 1988, remember this: These trusted celebrities are increasing their wealth by being well-paid for the ads in which they appear.

Undeniably, reverse mortgages may work well for some seniors who wish to remain in their homes and who have the discipline to do everything right. But, while ads imply that you cannot lose your home with a reverse mortgage, you should know that you can. Indeed, in 2012, one out of every 10 owners of reverse mortgages was in default. Here is what you need to know if you decide to apply for a reverse mortgage loan. Your home’s equity is used as collateral for a reverse mortgage loan that generally does not have to be repaid until the last surviving homeowner permanently moves out of the property or passes away. Interest and handling fees are added to the loan each month. During the time the homeowners are in the home or temporarily away — for example, a brief stay in a nursing home — they are responsible for taxes, insurance and maintenance of the home. Failing to do so results in foreclosure. When the last surviving homeowner moves permanently (12 months) out of the home or dies, the estate then has approximately six months to repay the balance of the reverse mortgage or sell the home to pay off the balance. Any remaining equity is inherited by the estate and the estate is not personally liable if the home sells for less than the balance of the reverse mortgage. A reverse mortgage works best if the borrower is older and has no or a small mortgage on their home because any mortgage must be paid off first with proceeds of the reverse mortgage loan. As life expectancy has risen, more people are living into their 80s and 90s, many into their hundreds. It is easy to see how they can outlive the proceeds of the reverse mortgage loan, especially if they take the money in a lump-sum and are not disciplined about spending the money. JAAA Executive Director Jocelyn Lyons is her family’s matriarch and chief caregiver. Her strong-willed grandmother, then 96 — without allowing Jocelyn time to research other options — took out a reverse mortgage loan so she could stay in her home. Affectionately known as Gran, she initially withdrew $1,000 to host a Thanksgiving dinner for her entire, and very large, extended family. When added to the monthly fees and interest, that $1,000 grew to $12,000 in only four years. The rest of the loan money remained unspent. The family, especially Gran’s son who had purchased the house for her, thought that $12,000 would not be too much to pay off the loan if Gran died as it looked she might do at age 100 when she was very ill. |

Happily, Gran did not die then and the bulk of the loan proceeds remained untouched until she entered a nursing home. Her savings, CDs and the rest of the reverse mortgage loan paid for her stay in the nursing home. Although Gran’s son had been required to remove his name from the deed so she could apply for the reverse mortgage loan, it was expected that the house would be returned to him upon her death, provided he purchased the house from HUD (US Department of Housing and Urban Development) by paying off the loan.

Sadly, after her money ran out, Gran was forced into applying for Medicaid because the lending company, without the approval of HUD, would not allow Jocelyn to use the remaining $13,000 of the loan to pay for her grandmother’s care. The attorney who assisted Jocelyn in applying for Medicaid for her grandmother also advised her to cease paying taxes, insurance and utilities on the house since Gran would never return to it. But Gran insisted that the utilities remain on so that visiting out-of-state relatives could stay without incurring hotel costs. When Gran died at age 104, the son who purchased the house for her informed the lending agency of her death and said he would like to talk to them about paying off the mortgage to buy the house. They said they would “get back to him” but, in the meantime, required him to continue to pay the taxes, insurance, maintenance, utilities, interest and fees. Eighteen months later, they still had not “gotten back to him,” and he decided that — with 18 months of additional interest and fees — the amount of the loan exceeded the value of the house. He advised the lending agency that he was no longer interested in buying the house and that he planned to have the utilities turned off. They informed him they would not accept release of the house until it had been thoroughly cleared and cleaned (vacuumed, mopped, walls and windows washed) and gave him 10 days to have the work completed. He called Jocelyn who told him that, in a foreclosure, the lender customarily took care of those duties and readied the house for sale. However, her uncle was worried that he would pay a penalty if he did not have it done, so Jocelyn (family matriarch and house cleaner) personally cleared and cleaned the house. While her experience with Gran’s reverse mortgage loan was not positive, Jocelyn, when asked her opinion of such loans, says, “It depends on the situation. I would also want to learn more about a home equity loan.” She also recommends that seniors thinking about taking out a reverse mortgage loan be cautious, investigate other options and carefully check out the lending agency. Clearly, some are better than others and, if you decide a reverse mortgage is right for you, you will want your lending agency to be the best you can find when it comes to treating you fairly and responding promptly. |

HEALTH MATTERS MORE

I learned from my mother …

The importance of having a medical alert system

Marsha Henry Goff

The importance of having a medical alert system

Marsha Henry Goff

|

“Help! I’ve fallen and I can’t get up!”

Are there any of us who do not remember the commercial where that desperate plea for help was shouted by an elderly woman lying on the floor? I well remember two similar calls from my late mother. The first time she crawled to the phone and called me, she had fallen and broken her hip. A couple of years later, she fell and broke her femur and again crawled to her phone to call me for help. After she was widowed at age 56, it was Mom’s choice to live alone in the home where she and Dad had reared their four daughters. She gardened, baby-sat for grandchildren, visited with friends, continued to prepare income taxes for her clients and worked with census and voter registration. Although we worried about her living alone, my sisters and I recognized it was her right to choose where she lived. After the second injury, however, she agreed to the installation of a life-line which included a necklace with a button she pushed if she suffered an accident. The button allowed her to speak directly to a person who would call me or dispatch an ambulance if Mom required immediate medical care. In her later years, Mom used an electric wheel chair. Once I frantically drove to her home after receiving a call that she needed assistance, only to find that her wheelchair battery had run out of charge and she was trapped in a corner. Following |

that incident, I suggested she give the person she spoke with the details of her situation and say if she required an ambulance. “I’ll get here just as fast, Mom,” I promised, “but I won’t be in such a panic worrying about what is wrong if I know you aren’t injured.”

One does not have to be elderly to fall. I proved that once by hurrying down the steps to open our back door. However, if an elderly or disabled person who lives alone falls, it is much more difficult for them to obtain the help they need. Statistics show that nearly 10.9 million older individuals — 7.9 million women and 2.9 million men — live alone. Nearly half of women age 75+ live alone. Studies by medical organizations and the Consumer Safety Product Council show that falls in and around the home are responsible for the majority of injuries and hospitalizations for people 65 years and older. Those studies indicate that 1 in 3 people over the age of 65 will suffer a major fall each year. The medical-alert system can be a lifesaver in the event of a fall, fire or home invasion. Costs of monitoring such a life-line usually range from $30 to $50 a month, although an Internet search reveals one that costs only $15.95 per month. Over 200 of JAAA’s clients have medical alert systems. More seniors could benefit by having one. If you have questions about medical alert systems, please call JAAA at 235-1367 (in Topeka) or 1-800-798-1366. |

I learned from my mother …

Urinary tract infections can be deadly in elderly patients

Marsha Henry Goff

Urinary tract infections can be deadly in elderly patients

Marsha Henry Goff

|

Half of all women will have a urinary tract infection (UTI) in their lifetimes. A UTI (bladder infection) is the body’s second-most common infection type — more likely to occur in women than in men — and, according to the National Center for Health Statistics, accounts for nearly 8.3 million doctor visits each year. For some women, the condition may become chronic. One in five women who have a UTI will have a second infection; almost 30 percent of those with a second UTI will have a third. While UTIs are easy to cure with antibiotics, if left untreated, they can be deadly and are a leading cause of sepsis, a potentially life-threatening infection of the bloodstream.

Several years ago, I was at a therapy session with my hospitalized mother when her condition deteriorated rapidly, frightening both me and the physical therapist, who rushed Mom back to her room. Mom was a sharp-as-a-tack 83-year-old, still filing income taxes for her clients and an avid fan of Jayhawk basketball. In her room, where the bulletin board prominently noted the times of KU basketball games, I asked her nurse to summon the doctor. “Something is radically wrong,” I insisted. “She’s confused,” said the nurse who had been interacting with Mom for several days and knew that wasn’t her common state. “That’s why I know something is wrong!” “Well, she’s old,” the nurse replied. Once summoned, the doctor recommended hospice care for Mom. My sisters and I were stunned, but arranged for our mother’s transport home the next day. The hospice nurse said that Mom, whose breathing could be heard in the farthest corners of the house, probably wouldn’t live more than a few hours. |

What put my mother at the brink of death was the onset of sepsis from an untreated UTI. The symptoms of a UTI in the elderly are very different from those in younger patients. In fact, sudden confusion or an abrupt change in behavior in elderly individuals should be a red flag for medical personnel, caregivers and family.

In such cases, family members who intimately know the individual must be prepared to be assertive in telling doctors and nurses that such behaviors are unusual. Not all physicians and nurses will dismiss symptoms as casually as my mother’s nurse did, but it does occasionally happen. Other UTI symptoms include general discomfort, blood in the urine, a feeling of being overly-tired and pain during — and even when not — urinating. Back and side pain may indicate the infection has reached the kidneys. Men might feel fullness in the rectum. UTIs in men can lead to prostatitis. An elderly individual will rarely run a fever, but if he or she does, it is considered an emergency and an indication of a serious infection. Among things you can do to try to prevent UTIs are drinking plenty of water, getting proper nutrition and completely emptying your bladder when urinating. Some studies have indicated that drinking cranberry juice may ward off UTIs. My mother was fortunate to survive her UTI-induced sepsis. My sisters and I opted to administer strong antibiotics which we asked the doctor to prescribe and, in spite of being nursed by four daughters with good intentions but no medical training, Mom was dismissed from hospice care two weeks later. Her family is grateful that she enjoyed four more productive and happy years with us. |

Shingles is an Infection Best Avoided

Marsha Henry Goff

Marsha Henry Goff

|

On a bright May morning in 2010, Blossom Laing, Topeka, noticed a slight rash on her right ribcage. “I was unconsciously scratching it,” she remembers, and she took the precaution of treating it, as she would any rash, by rubbing on cortisone cream. It was the wrong treatment because Laing had shingles virus, an infection that causes a painful, blistering red skin rash. While the infection is most common in older adults, only those who have had chickenpox can get shingles.

Called the herpes zoster virus or varicella zoster virus, the infection usually enters the body in childhood and causes chicken pox. Once in the body, the virus can lie concealed in the spinal cord and brain for years before it triggers shingles. When Laing, who has a high tolerance for pain, realized the rash was hurting, she wondered if she might have broken ribs. She didn’t realize she had shingles until a player at a bridge club meeting described her shingles attack. Laing immediately thought, “That’s what I have.” A doctor confirmed Laing’s self-diagnosis and prescribed Lidocaine for the pain. Although Laing believes she was spared the near-unbearable pain suffered by some shingles victims, she did suffer from fatigue and body aches. She admits that, “There were days I just didn’t get out of bed.” She felt better in a couple of months, but the rash, which spread to her back, did not completely disappear until September. She advises friends to “get the shingles shot” and deems the vaccination worth the cost. Called the varicella-zoster vaccine, the shot is expensive — about $200 — but Medicare Part D, depending on your plan, will often pay for some or all of it. |

While most cases of shingles, though painful, heal on their own, if you should get shingles, it is important to start treatment within 72 hours. It is especially important to seek medical attention if the shingles rash is near the eye which can, in rare cases, cause blindness. Doctors will likely prescribe pain medication and antiviral drugs to fight the infrection. Early treatment can shorten the disease’s duration and lower the risk of complications. It is recommended that you avoid scratching or touching the rash as doing so may spread it, but you may use cold compresses to ease the pain.

Laing fortunately escaped the complications that can occur as a result of a shingles infection, among them: skin infections; encephalitis; vision or hearing loss; balance problems; facial paralysis; and pain that continues long after the skin has healed. The most common complication, suffered in about 30 percent of older victims, is postherpetic neuralgia, which can lead to months or years of continued pain. Up to ten in every thousand seniors develop shingles each year. Without the vaccination, 10 to 14 percent of them will suffer from neuralgia. With the vaccine, the risk of getting shingles is reduced by half and the risk of serious complications is reduced by two-thirds. The vaccine has been available since 2006, but, according to the Center for Disease Control and Prevention (CDC), less than 7 percent of US seniors — those most likely to be affected by the disease — chose to receive the vaccine as of 2008. That percentage is slowly increasing, but most seniors have not been vaccinated and are not protected from shingles. Are you one of them? |

WU Moves keeps seniors moving

Marsha Henry Goff

Marsha Henry Goff

|

Bob Fulton is an active participant in WU Moves Community Wellness Program at Washburn University. He is quick to share that he once weighed 280 pounds and now weighs 229. But Dr. Park Lockwood, PhD, Associate Professor and Program Coordinator for the WU Moves Program, says Bob had already lost some of the weight before he began the program. “He’s lost about 30 pounds during his time with us.”

Bob is a gregarious gentleman who likely never met a stranger nor made an enemy. He worked many jobs in both Topeka and Lawrence and was always very active, very busy. He and his lady, Mary Corcoran, began the program together. Mary is a native of Long Island, New York, who was transplanted to Georgia and moved to Topeka 11 years ago because of Hurricane Katrina. She does not have a weight problem, but says she had double heart bypass surgery in 1997 where “they took the veins from my leg and put them up there.” She is confident that “the program has helped me because it keeps me going.” Sylvia Vaughn is attractive, fit and carries herself as if she were previously a model; instead she says, “I worked for the State of Kansas in the revenue service.” She works diligently on the exercise equipment because she wants to stay fit. “We enjoy the program,” she says with a smile. One of the hardest workers in the class is Larry Wynne who suffered a stroke a couple of years ago which affected his left side. During his working years, he worked at Boys’ Industrial School, nursing homes, a restaurant, Kansas Neurological Institute and Menninger’s. He drove a handicapped bus for the school district and retired from the state. His fondest desire is to “get out of this wheelchair. I’ve been doing pretty good. I do everything at home by myself, except for cooking and washing my own clothes, but as far as taking a bath or shower, I do that myself. I do everything because I don't want to depend on people, so I just do it myself.” Park Lockwood is proud of all the participants, but he singles Larry out: “The first time, we helped Larry stand and we helped him balance. Then Larry got this idea that he could pull himself up and now he pulls himself up and stands for not his original 20 shaky seconds, but for one minute and thirty-five solid seconds today, a new record.” |

Nancy Babcock does not allow a heavily wrapped arm keep her off the stationary bike which is her favorite aerobic exercise equipment. “I hurt my elbow, yanked all the muscles out. I like the bicycle. First I could just do just a little bit, now I'm up to 22 minutes. I also work on balance.”

Nancy learned about the program from her senior center. Before retirement, she spent 10 years as a school lunch lady. “I fed the kids. We had four or five hundred kids.” Lockwood is assisted by Tanna Terry and KayLee Farmer who serve as Wellness Assistants, and intern Meaghan Reed who leads the Yoga Group. Park Lockwood is especially pleased to have Tanna Terry as an assistant because she has a degree in Kinesiology from K-State and is a presently a nursing student at Washburn. “We were hoping to find someone who had those two skills,” he says. Kinesiology is described as “the academic discipline which involves the study of physical activity and its impact on health, society, and quality of life.” He says the program actually began in Lawrence when his wife was employed with Health Care Access and mentioned that they’d like to start a preventive health program. He developed a model and successfully applied for a grant with Topeka Foundation. When the program moved to Washburn in the Fall of 2016, they received a $10,000 internal grant which bought some needed equipment and is used to pay the student workers. Because the program is free of charge, Washburn Moves Community Wellness Program still relies on grant money to continue. There are about 70 people enrolled in the program’s three groups — East Topeka, Weight Management and Yoga — or who come in for individual appointments. Objective data is kept in three month, six month and one year assessments and is shared with the participants. In the last three month assessment, Lockwood is happy to report that the objective data he collects proves that “everything that should be going up (good cholesterol, oxygen uptake, endurance, functional strength) is going up and everything that should be going down (blood pressure, glucose, resting heart rate, weight, body mass index) is going down in numbers better than I expected.” The program currently has a waiting list. Should you wish to add your name to it, please call Washburn’s Kinesiology Department at 785-670-1459. |

WATCH OUT FOR SCAMS

Don’t be a victim: protect your bank account and your identity

Marsha Henry Goff

|

Good-hearted seniors are often victimized by unscrupulous individuals (often called scammers) whose goal is to empty their victim’s bank account while fattening their own. Being aware of scammers’ methods can save you money and humiliation. Here are a few scams that have been practiced lately in the area served by JAAA and actions you can take to keep from being a victim.

If it sounds too good to be true, it probably is. It is hard to resist the idea that one can become wealthy overnight and there are a number of scams that encourage this belief. All of the scams have one thing in common, however. The victim is required to part with a significant amount of their own cash for the opportunity to rake in a bigger haul. If you are offered such a proposal, whether in person, by phone or e-mail, walk away, hang up the phone, delete the unsolicited e-mail. Never give your hard-earned cash to a stranger who approaches you with a “too good to be true” proposal. One such scam, known as a “pigeon drop” involves two scammers who persuade the pigeon (victim) to give up a sum of good-faith money in order to share in a larger sum (often an envelope of cash supposedly found on the street). The scammers make off with the envelope as well as the victim’s money, leaving the victim with nothing. The online lottery scam has attracted many victims because they did not remember this simple fact: You cannot win millions in a foreign lottery that you did not enter. Do not allow your “good-heartedness” to make you a victim. A 90-year-old Douglas County woman lost $18,000 last summer when she wired the money to Canada after receiving a phone call saying her grandson was in jail and needed to be bailed out. This scam has proved especially effective with grandparents who have the means and a willingness to help loved ones. Once the money is wired, it is gone. You will never recover it. If you receive such a call, purporting to be from a grandchild or other relative or even from a supposed law enforcement officer, authorities suggest that you ask a question only your grandchild would know. Be creative: mention a pet that does not exist or a trip that did not occur. Although such scam artists do their research (often using social media sites), they will not be able to respond correctly to made-up events. The obvious thing you can do is to call the grandchild who is allegedly in trouble. One grandparent did that only to find her grandson at work, not in jail. |

Protect yourself from identity theft. Know this: your bank or credit card company will NOT phone or e-mail you and ask for your account or social security numbers. They already have that information. Never give such information over the phone to someone who calls you, regardless of how they identify themselves. If you have concerns about the call, phone your bank or credit company. A recent scam in the area soliciting identity information is known as the “jury scam.” Someone phones and claims you did not report for jury duty. Once they have you off-balance because you did not receive jury duty notification, they ask you for private information. Do not give it to them and save yourself a lot of grief.

Do not trust fly-by-night contractors who appear at your door. Just because your word is your bond, do not think that everyone is honest. Sadly, they are not. A Kansas City area woman signed a contract and paid $9,000 to have her roof replaced and never again saw the man, who told her he required the money to buy roofing supplies. While the price offered may be less expensive than that bid by local, well-established contractors with a physical building in the area, the most expensive thing the fly-by-night contractor may have invested in is an inexpensive magnetic sign on the side of a truck showing a fake business name. Unless you have previously dealt with a business, check it out through your local Better Business Bureau or Chamber of Commerce. You can also ask friends for recommendations or consult Angie’s List online. Be especially cautious of anyone who tells you that you must decide or sign a contract immediately. Seniors are not the only victims caught in such scams. One teenager sold his motorcycle online only to receive a personal check for $1,000 over the asking price. He was quickly contacted by the “buyer” who said he had made a mistake and asked the teen to send the extra $1,000 back immediately. The teen, acting in good faith, did and — you guessed it — the personal check bounced, leaving the teen with a motorcycle he did not want and a flattened bank account. Still, seniors are frequently the victims of scams because they are trusting, unfailingly polite and eager to help. They are often unwillingly to end an unsolicited phone call by rudely hanging up. One senior says she finally found a way to hang up without being rude. She says to the caller, “Thank you so much for calling, but I must hang up now. Have a great day!” CLICK. Try it, it works. And, please, be very careful about inviting strangers into your home. Do not allow anyone to make you a victim. |

Scam Relies on Grandparent’s Love for Grandchild

Marsha Henry Goff

Marsha Henry Goff

|

Hugh is a highly intelligent 83-year-old retired university professor who lives in Oregon. He picked up the phone last week to hear, “Grandpa?”

“Michael?” inquired Hugh. “Yes, Grandpa, it’s Michael.” Convinced he was speaking to his grandson, a college student, Hugh took notes as he was told Michael was attending a wedding out of the country, was in jail and needed $4,400 wired via Western Union. When Hugh asked why Michael had not called his parents, the caller said he was too embarrassed to ask his parents for help. The scam artist was following a script that has proven extremely successful in stealing money from loving, well-intentioned grandparents. What the thief did not count on was that Michael’s parents, who live in Missouri, were visiting and could hear both sides of the conversation because Hugh, who is hard of hearing, had the phone’s volume set at its highest level. “That’s not Michael,” said Michael’s mother. Michael’s father agreed. “No, that’s not Michael.” But Hugh was certain he was speaking to his grandson who needed his help. He was not fully persuaded the call was a scam until Michael’s parents contacted Michael and had him speak to his grandfather to assure him he was at home attending summer school, was not in trouble and did not need money. The call came from an area code in Canada, although that was not the country where Michael was said to be in jail. It was |

painfully obvious to Michael’s parents that, had they not been visiting Hugh, he would have been scammed out of $4,400.

The Better Business Bureau offers the following advice to protect yourself from the “Grandparent Scam”:

Many intelligent and loving grandparents have lost money to scammers because they were unaware of the scam and unprepared for the call. You worked hard for your money. Do not let a thief scam you out of it with a phone call. |

Marsha Henry Goff

|

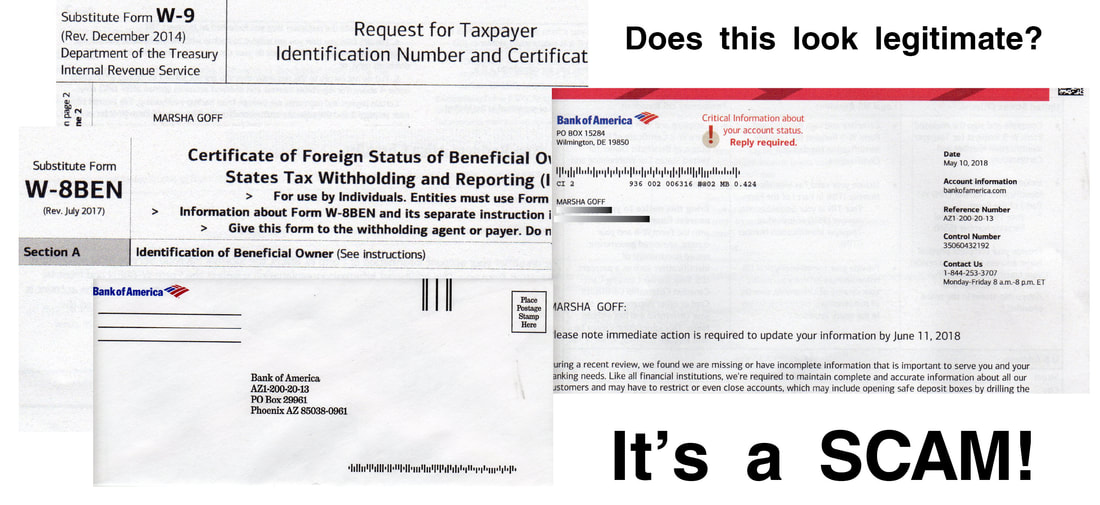

They say there is a sucker born every minute. If my mail, email and phone messages are any indication, there must be 10 crooks and scam artists born every second. When I received the above mailing, I had to admit that it looked legitimate. The mailing consisted of 12 pages, two of which appeared to be IRS forms. A couple of things appeared a little off to me: the critical information needed was my birthdate and the return envelope was not postage paid.

My natural skepticism — due, I believe, because my late father was a lawyer and my husband is a former police officer — has served me well. But I wonder how many people might have been fooled, and perhaps even scared, by the official-looking IRS documents. Should you receive such a letter, throw it away. It is an effort to get information from you that will allow your identity to be stolen. I recently received an email from a credit card company that looked legitimate. No words were misspelled, but it asked for information they should have had and I was reluctant to give again. I called my son who is an IT and he told me to hover (but not click) my mouse over the link and from the information that popped up he was able to determine the email came from Indonesia. I called the credit card company and they asked me to forward it to their fraud department, which I was happy to do. I once received a call where a young-sounding male voice said plaintively, “Grandma?” “Nope,” I said, “Goodbye,” and hung up. I know my grandchildren’s voices. But what if I were hard of hearing or |

wore a hearing aid that distorted sounds and I was not able to recognize their voices? Sadly, many loving grandparents are duped into sending money they believe will help grandchildren. If you think you are actually talking to a grandchild in trouble, check out the story with their parents or call the grandchild yourself. One grandparent had second thoughts and called her grandson after wiring money because she believed he was in trouble in a foreign country. She learned her grandson was at work and her money was in the pocket of a foreign scam artist.

My sister has received several calls from someone purporting to represent the IRS who threatened to have her arrested. It is a scam as are the callers who claim to represent utility companies demanding immediate payment over the phone. It is against many people’s kind nature to hang up on such callers. Despite my skepticism, I, too, am reluctant to abruptly slam the receiver on an unwanted call. So I sweetly say, “Thank you for calling. Goodbye,” before I disconnect. Try it. It usually works because they know you are on to them. Where does a scam end and blackmail begin? A friend recently received an email threatening to post pictures of her watching porn if she did not send them a huge Bitcoin payment. Connected to the message was one of her old passwords that they had extracted from one of many recent password breaches. She called the FBI. To avoid being the victim of a crook, do this: keep your information private, your money in your wallet and never allow anyone who calls you to take over your computer. |